Best Forex Brokers Canada 2023: Top Canadian Forex Brokers!

Forex trading, also known as foreign exchange broking, refers to swapping national currencies from registered exchanges or brokers. Forex can be used to exchange national currencies for any user’s particular purpose, including personal use, travel, investment objectives, etc. The Best forex brokers Canada especially saw a rise after introducing digitized platforms by the best forex brokers, increasing investment opportunities for standard and swing traders.

Registered Canada forex brokers should adhere to regulations to operate in the investment and trade industry, and regulatory organizations are more reliable for forex trading. Canadian traders should always go with reputed platforms, desktop platforms, or others that have a smooth exchange flow through their forex trading accounts.

Please note that the information in the below content has been provided with various online research conducted by us to guide you and help you choose the right broker. Before starting, remember trading CFDs carries risk, and you may lose money, so always be careful.

Best Forex Brokers Canada in 2023

Our top 8 list of IIROC-regulated forex brokers for trading in Canada are:-

- CMC Markets:- Best for Range of Offerings

- Interactive Brokers:- The best choice for Both Institutional Traders and Professional Traders

- Forex.com:- Best for Beginners, Automated Traders, and Advanced Professionals

- OANDA:- Best for Forex Traders in Canada

- Fortrade:- Best for Educational Resources and Strategies Along With Market Analysis

- Questrade:- Best Suited for Self-directed Investors and Traders

- Friedberg Direct:- Best for the Overall Trading Experience

- City Index:- Best Research and Educational Tools and Low Forex prices

Comparison of Best Brokers in Canada

| Forex Brokers | Minimum Deposit | Maximum Leverage | Regulated by IIROC | Accepts Canadian Citizens |

|---|---|---|---|---|

| CMC Markets | $0 | 30:1 | ||

| Interactive Brokers | $100 | 50:1 | ||

| Forex.com | $100 | 50:1 or 2% | ||

| OANDA | $0 | 50:1 | ||

| Fortrade | $100 | 1:30 | ||

| Questrade | $1000 | Yes | ||

| Friedberg Direct | $5000 | 1:33 | ||

| City Index | $100 | 30:1 |

8 Best Forex Brokers Canada List

We provide a long list of the best Canadian forex brokers in Canada for Canadian traders to choose it. While the preference and usage of traders might lead to different platforms for everyone, some of the more reputed and leading platforms for trading FX.

CMC Markets

CMC is a great option among the leading Canada forex brokers platforms, which is also the most trusted and adheres to regulations regarding safety and security, a notion common throughout various providers in the domain. Its forex market is regulated by FCA (U.K.).

These brokers in Canada are also listed on the London stock exchange, and the site has maintained a good long track record of user accounts. The regulatory environment body is reputed around the world, with its features like negative balance protection, which serves as a testament to the site’s reliability.

| CMC MARKETS OVERVIEW | |

|---|---|

| Regulated By | IIROC, MAS, ASIC, FMA, FCA (U.K.) |

| Best For | Best for Range of Offerings |

| Year Founded | 1989 |

| Minimum Deposit | $0 |

| Maximum Leverage | It Is Generally 30:1, Which Comes from Margin Costs of 3.3%. However, the Leverage Ratio for Forex Pairs and Cryptocurrency Pairs Can Differ Greatly. |

| Tradable Assets | Forex, CFDs, Spread betting, Commodities, Stocks, Treasuries, Custom Indices |

Canadian traders can expect a reliable and safe regulatory environment for the trading strategy with minimal leverage risk to their information and funds. CMC Markets have emerged as a market leader in the growing user base for different news trading style.

Most traders should be aware that trading with cryptocurrencies involves a liquidity risk and price swings and should be careful when they are trading. The CMC Markets is among the market leaders for trading forex in Canada.

They have been regarded as the leading forex broker in Canada and have a good reputation in New Zealand; thus, it can be recommended to all traders for various account types of trading tools & trading styles.

CMC assets cover various categories of trades, and the active traders can choose from various forex assets to trade (like forex and CFDs) using the Forex trading account. There are no minimum deposits or maximum deposit values fixed by CMC, and users trading in Canada can invest as little money as they want to risk or trade.

The company has a more significant list of tradable assets, is the leading forex broker in Canada, and the accounts can be used for 12 crypto & 2 indices.

CMC markets have also received a few rewards for having lucrative options and positively impacting retail investor accounts. It has the largest catalogs and offerings of major currency pairs in the Canadian forex market, even in New Zealand.

However, check out our CMC Markets review to learn more about this online platform, its financial services, and its features that benefit Canadian traders. Although, there is also a provision for dealing with cryptocurrencies, which is also commonly seen among platforms like IFC markets, Saxo bank, Fusion Markets, IG markets, etc.

The significant difference between transacting with cryptocurrencies and dealing with forex pairs is that cryptocurrencies work in conjunction with extreme volatility; beginners should have a thorough understanding before charting into new waters through the website, even if the broker is regulated.

The cryptocurrency trading market works distinctly from the market moves, but the platform’s flow is considered one of the better ones. Also, if the customer has any doubts, they can check its FAQ section to solve them and earn huge profits in the process.

Pros

- CMC markets offer excellent mobile and web-based version along with account options.

- The top brokers provide advanced education and research resources along with a range of research tools.

- The forex prices are lower and provide negative balance protection.

Cons

- The product portfolio is limited. Clients from South Africa are not supported.

- CFD trading prices are higher.

- Customer support needs to be improved.

Fee Structure

CMC markets charge highly competitive stock index CFD indices and low trading fees. It does not charge for deposits and withdrawals, but the trading fees are higher for stock and trading CFDs. CMC markets also charge £10 as inactivity account fees if the account is inactive for one year.

Interactive Brokers

Founded in 1978, It is a great choice & a well-known and industry-leading brokers in Canada. It has several licenses and adheres to regulations in tier-1 jurisdictions, and has more than 170 billion US dollars in inequities. Interactive Brokers LLC has several entities operating under its parent organization and has a good long track record.

Interactive Brokers is regulated by the SEC (the US Securities and Exchange Commission) and commodity futures trading commission (CFTC).

| INTERACTIVE BROKERS OVERVIEW | |

|---|---|

| Regulated By | IIROC, SEC (US), CFTC |

| Best For | Both Institutional and Professional Trader |

| Year Founded | 1978 |

| Minimum Deposit | $100 (For Interactive Brokers LLC brokerage account) |

| Maximum Leverage | 50:1 |

| Tradable Assets | Forex, Stocks, Bonds, Commodity, Metals, Futures and Options, Mutual Funds, and ETFs |

Interactive Brokers is in Forex regulation with several top-tier officials and international agencies. Interactive Brokers also provides information on different investment opportunities to its customers, making it unique compared to its competition, like Saxo bank, Fusion Markets, etc. However, if you want to explore more in detail about the Interactive Brokers review platform & its features, we have it covered.

Pros

- Interactive Brokers can be customized easily.

- Provides advanced order types & charting tools.

- Diverse & large options trading for investing opportunities.

Cons

- Higher maintenance prices.

- Complex trading software.

Fee Structure

The Interactive Brokers follow tiered pricing plans that offer low broker commission & somewhat low trading fees as it goes down depending on the trading volume; it also includes other regulatory bodies, exchanges, market offers, and clearing rates.

Forex.com

Founded in 2001, Forex.com is one of the best brokers for trading in Canada and provides services in Fx for retail investors. It is regulated by NFA, CFTC, FCA, CySEC, Investment Industry Regulatory Organization of Canada IIROC regulation in Canada, ASIC (investments commission), and many more.

| FOREX.COM OVERVIEW | |

|---|---|

| Regulated By | IIROC, FCA, FSA, CySEC, MAS, ASIC, CIMA, NFA, CFTC |

| Best For | Best for Beginners, Automated Traders, and Advanced Professionals |

| Year Founded | 2001 |

| Minimum Deposit | $100 |

| Maximum Leverage | USD/CAD 50:1 or 2% |

| Tradable Assets | Forex, CFD, Crypto, Futures and Options, and Stocks |

It is the biggest online CFD and retail forex broker in Canada, and it is one of the top picks by traders. It facilitates and offers access to international markets that include the full suite of stocks, Forex pairs, trading cryptocurrencies, commodities, fixed spreads (variable spreads), and indices.

It provides the largest range of feature trading services, the share trading mobile apps for trading, analysis tools, trading tools, proprietary trading platform, trading view charting, provides info on its financial products and services, live chat, support from global banks, the Canadian bank, top liquidity providers, and has trade size of around 1000 units.

These proprietary platforms provide detailed information and an excellent encounter for Canadian citizens who want to trade in Canada’s vast forex market share. Even beginner traders get a chance to trade both forex and CFDs.

You should also check our Forex.com review page to know more details about its financial services, features, forex trader pro platform, and more about this leading broker in Canada.

Pros

- Forex.com provides great trading software.

- This Leading broker in Canada has a wide range of resources and offers low spreads and support for forex and CFD traders.

- Provides great educational and research resources.

Cons

- Fundamental data is missing.

- The customer support team needs to be improved.

Fee Structure

This broker charges an inactive account charge of 15 US dollars a month if the user does not use his account for 12 consecutive months. Additionally, the trader can be charged roll-over rates if they hold their positions overnight; there are no charged fees during day trading.

OANDA

Established in 1995, Oanda Corp is one of the registered forex brokers in Canada and is a dealer and futures commission merchant. Several top-tier authorities regulate it. It has an average daily trading volume of $10.7 billion.

This best forex broker offers standard and commercial access for Canadian citizens to access the forex and CFD markets by offering several large range of major currency pairs to trade with this broker.

| OANDA OVERVIEW | |

|---|---|

| Regulated By | IIROC, FCA, MAS, ASIC, CFTC |

| Best For | Best for Forex Traders in Canada |

| Year Founded | 1995 |

| Minimum Deposit | $0 |

| Maximum Leverage | 50:1 |

| Tradable Assets | Forex, Cryptocurrencies, CFDs, Currency Pairs, Spread Betting, Oil, & Metal |

This broker does not require a standard minimum deposit if the new trader wants to open a new account with this broker, which is only valid for the standard accounts (sometimes also called the classic account), not for other account types.

Oanda Canada offers one of the top trading conditions of high leverage offered of up to 1:50 when the user is trading with high-risk derivative instruments on currency pairs and has a high risk of losing money.

Canadian traders should have sufficient funds in the user accounts to meet this broker’s margin calls & initial deposit requirements to start the forex trading journey and make their trade moves.

Oanda being a top international broker, also offers a full range of custom indicators and comprehensive charting tools that can be useful for expert Canadian traders to trade in the market. It also offers an interactive and simple user interface that new traders can use for any forex trader in Canada and no dealing desk intervention.

If you are looking for a user-friendly range of currency pairs & forex trading platform with good educational and research sources, you are at the right place. However, find more information about these leading brokers in Canada from our honest Oanda review, in which each detail is presented to guide you.

Pros

- Provides an easy-to-use platform with various trading instruments and support for forex and CFD traders.

- Easy and fast account opening with different account types of support.

- Oanda in Canada Offers great educational and research tools.

Cons

- Tradable valuables are limited.

- Customer support needs to be improved.

Fee Structure

The low trading fees offered by these online brokers are highly competitive spreads (tight spreads) and straightforward. It does not offer a deposit bonus when the user signs up with their platform. The user should constantly check the official website to see if there are any changes in the roll-over rates or financing charges.

Oanda has low Forex rates, but the CFD trading fees are average. The withdrawal fees are low, and the broker also charges a small inactivity fee.

Fortrade

In 2013, Fortrade Limited was established in the UK for trading and is gone quite popular and become one of the Best forex brokers in Canada. It is regulated by the FCA (Financial Conduct Authority), ASIC regulated Australia, NBRB Belarus, Cysec Cyprus, Cyprus securities, and IIROC- Investment Industry Regulatory Organization of Canada. In the last few years, this best forex broker has established several offices across the globe, and it is regulated in Canada, Australia, Cyprus, etc.

| FORTRADE OVERVIEW | |

|---|---|

| Regulated By | IIROC, FCA, CySEC, ASIC, NBRB Belarus |

| Best For | Best for Educational Resources and Strategies Along With Market Analysis |

| Year Founded | 2013 |

| Minimum Deposit | $100 |

| Max. Leverage | 1:30 |

| Tradable Assets | Currency Pairs, Indices, Precious Metals, Commodities, Bonds, Cryptocurrencies, Stocks, and ETFs |

This is an International broker that offers trading opportunities over several asset classes. This broker offers a high degree of leverage of up to 1:30 with limits depending on the market volume.

Fortrade is one of the excellent trading platforms that offer a simple and easy-to-use trading platform that can be used even to open account type of traders choice without any hassle. You can also explore more about the platform in our Fortrade review, which we have covered.

Pros

- The trading platform is user-friendly.

- The best brokers provide an in-depth important economic analysis of the markets.

- Wide range of educational materials and solid research tools.

Cons

- They charge an inactivity fee.

- Does not serve traders from certain countries.

Fee Structure

Fortrade does not charge commissions, but instead, they add costs hidden into the tight spreads.

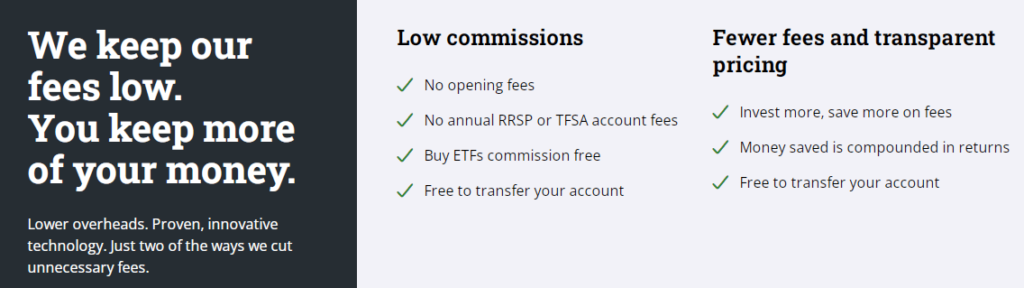

Questrade

Questrade Inc is one of the top Canadian brokers and provides an in-depth, one-stop solution for trading forex. Questrade is a registered name in investment dealer and is authorized by Canada’s investment industry regulatory organization (IIROC regulated).

Questrade has recently won the best Canadian brokerage award in 2022; It is also a member of CIPF (Canadian investor protection fund), which provides 1 million US dollars in security. It has an inbuilt trading platform that can be directly accessed from the website (web trading) or the mobile app. The trading accounts are multifunctional and straightforward to use.

| QUESTRADE OVERVIEW | |

|---|---|

| Regulated By | IIROC, CIPF (Canadian investor protection fund) |

| Best For | Best Suited for Self-directed Investors and Traders |

| Year Founded | 1999 |

| Minimum Deposit | $1000 |

| Max Leverage | Yes |

| Tradable Assets | Indices, Forex, CFDs, Metals, Mutual bonds, Stocks, etc. |

Questrade is well-known for self-directed investors; Questrade in Canada offers its customers a fundamental analysis research trading platform and market intelligence analytical tools. It is also recommended for investors and traders who focus on the US and the Canadian fx traders markets. However, explore more about the platform in our Questrade review, where we have all the details in depth.

Pros

- Stock and ETF fees are low.

- Easy to use platform.

- Provides a wide range of technical and educational tools.

Cons

- Account opening is slow.

- Withdrawal prices are high.

Fee Structure

Questrade total trade costs are included in all-inclusive spreads (low spreads), implying that customers may not pay additional commissions for a trading account. The minimum spread on one of the most popular currency pairs (EUR USD) starts at 0.8 pips.

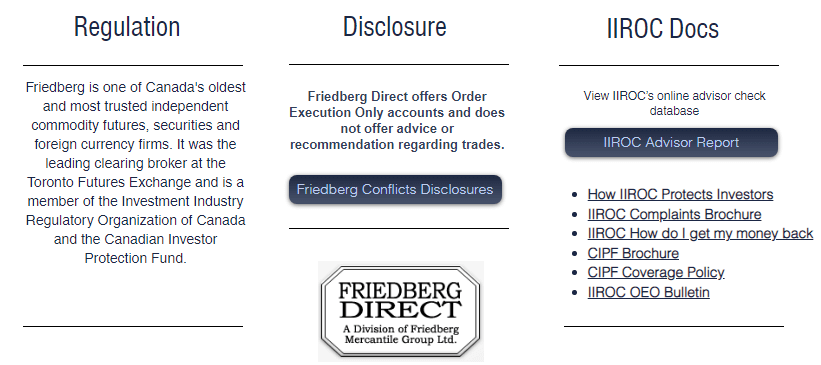

Friedberg Direct

Founded in 1971, Friedberg Direct is one of the biggest independent Canadian traders based brokers (As per the Canadian authorities). Friedberg Direct is a well-known platform & is a member of the Investment Industry Regulatory Organization of Canada IIROC (a part of Canada’s Investment dealers association), CIPF, or the Canadian Investor Protection Fund, and a member of several Canadian trading areas.

| FRIEDBERG DIRECT OVERVIEW | |

|---|---|

| Regulated By | CIPF, IIROC (Investment Industry regulatory organization of Canada) |

| Best For | Best for the Overall Trading Experience |

| Year Founded | 1971 |

| Minimum Deposit | 5000 US Dollars |

| Max Leverage | 1:33 |

| Tradable Assets | Forex, CFDs, ETFs, Metals, Stocks, Commodities, Gold, Currency Pairs, and Crude Oil |

It is a Toronto-based discount brokerage offering direct market access to non-US residents to find the right Forex currency pair that can be traded through its platform. Traders from Canada looking to use fixed spreads (floating spreads or tight spreads) in the trading session and trading volumes per need can use this broker powered by Avatrade. One of the reputed CFD markets and best forex brokers in Canada runs the Friedberg direct trading platform.

This ECN broker also offers platforms like MetaTrader 4 and MetaTrader 5 for its customers and provides a broad range of automated trading platforms, including Duplitrade, Zulutrade, and No dealing desk intervention. The IIROC regulation-enabled platform makes trade execution smooth for any trading account.

Pros

- This platform is regulated by its own local regulator.

- It offers a powerful trading platform with MetaTrader 4 and MetaTrader 5 support.

- Provides a wide range of educational tools, trading products, currency pairs, and research tools.

Cons

- Account funding options are limited.

- It usually takes time to open account.

Fee Structure

This broker does not charge any commissions aside from spreads; this implies that trading costs are already added to the fixed spread; thus, the minimum deposit requirements are none.

The mark-up on the EUR USD is 0.6 pips. The broker’s fixed spread is more comprehensive when compared with standard spreads (tight spreads) and does not have any commissions involved.

City Index

City Index is the know best forex brokers UK, established in 1983, and very popular among the masses, making it a pioneer in the trading industry for more than 30 years. It is recommended for CFD trading and FX traders looking for excellent research, educational aid, and low Forex cost. It is an Fx broker and a global CFD broker; it comes under the trading brand of StoneX Financial Limited. The parent company offers many features and is listed on NASDAQ.

| CITY INDEX OVERVIEW | |

|---|---|

| Regulated By | IIROC, FCA, MAS, ASIC, MiFID, UAE Central Bank in Dubai |

| Best For | Best Research and Educational Tools and Low Forex Fees |

| Year Founded | 1983 |

| Minimum Deposit | 100 Australian Dollars or 100 Pounds |

| Maximum Leverage | 30:1 |

| Tradable Assets | Forex, CFD, Cryptocurrencies, Spread Betting, Indices, Bonds, Currency Pairs Natural Gas, and Stocks |

The top financial regulatory authorities regulate this company like the FCA in the UK, (Australian securities) ASIC in Australia, and MAS in Singapore. It can be accessed across the globe. Here you can trade resources like forex, CFD, cryptocurrencies, average spread betting, MetaTrader 4 support, and stock trading. Although, go through our City Index review page to know more details about its offers & services.

Pros

- This online broker charges low fees for forex.

- The account opening process is fast and easy, along with demo account support.

- Provides a broad range of research and educational tools, currency pairs, and copy trading.

Cons

- The product portfolio is limited.

- The trading platform needs to be improved.

Fee Structure

As per several reviews, City Index charges low fees for trading with FX and does not charge any withdrawal amount. Besides, it has stock CFD rates and has base currency support like EUR/USD. The minimum deposit requirements are AUD 100 for forex trading in Canada; it also charges for inactive account after one year of inactivity.

Is Forex Trading Legal in Canada?

- Foreign trading in Canada is legal, despite the common conception about the state of online brokers and regex regulation (exchange commission). Fx traders can choose from the authorized traders for web platform trading with the help of preferred & best forex brokers in Canada to legally and safely trade forex pairs in Canada.

- The Investment Industry Regulatory Organization of Canada IIROC functions as the national regulator for the FX market order types. It governs or oversees forex trading platforms listed to do forex trading in Canada. Market makers are also key players as they set the costs for their customers themselves, and even limiting orders plays a significant role. As forex trading carries a risk, so just be mindful of whether you can afford to take the high risk.

- The regions of Toronto, Montreal, and British Columbia (British Columbia Securities Commission) also have local authorities to supervise financial transactions and trading of FX pairs (like the FP markets) available at the top Canadian forex brokers operating in the industry resulting in fast execution.

How Do I Trade Forex in Canada?

Fx traders who wish to start forex trading among base currencies can choose from the top brokers with a forex platform that can use their online resources by accessing their website. Interested Canadian investors around the world can then register on the trading platform’s website of the Canadian forex brokers which suit their trading needs, using the Canadian dollar and start trading.

If you are interested in Islamic account trade, check the platform support, which also may include support for the US dollar. These actions are also subject to the notice of the Canada revenue agency, which monitors top forex brokers in Canada and regulated brokers, as they act at their discretion.

Compared to other countries, Canada has an extensive range of trading instruments and account management systems; this can be used to deposit funds, money (Canadian dollar), or directly use online payment.

Credit card/debit card the bank wire transfer are some options for providers to pay the trading costs and gain capital in the form of FX funds or bonds, where expenses can be in tens of thousands of dollars. Then comes the market order, which provides you with a great price, and a smooth deposit and withdrawal process, but it’s up to you whether you can afford to take the high risk and trade.

Usually, many best brokers in Canada offer a simple and intuitive trading program and support of trading ebooks to trade; this makes them popular among Canadian residents that can help beginners, day traders, and advanced traders and help them understand account type, thus get started with easy and seamless use.

Most clients from Canada prefer to trade with a program that is available to trade with multiple devices such as computers and mobile apps (supports android and ios devices) so that FX traders can make exchanges with the help of forex brokers Canada (Canadian trader) on the go with utmost convenience along with that regulated brokers are a must. You can also opt for a limit order as required.

Choosing The Best Forex Brokers in Canada

Choosing an account for trading forex in Canada can be challenging and confusing for Canadian residents due to various copy trading platforms that appear similar and offer slight differences in either commodity trading CFDs, competitive pricing, market offers, or currency pairs that are provided by Canada forex industry for trading.

These factors can significantly affect one’s experience & net worth in the FX market and even lead to better swing trading market conditions, or momentum trading, which involves entering and exiting the market (primarily, scalpers nimbly enter and exit the market to capture small profits).

Even virtual money is provided by some of the best overall broker, that can help you adjust to the trading environment and provide you with the best forex brokers. Lastly, whether you can afford to take the high risk and go ahead with trading is up to you.

Broker Regulation

Canada pays due importance to forex regulation, and there is multiple regulatory agency that governs the implementation of forex rules and strict regulations. The Investment Industry Regulatory Organization of Canada IIROC – Investment Industry Regulatory Organization of Canada is one such central regulatory agencies,

It is common to find a local regulator in addition to the national one. You can visit IIROC’s official website, iiroc.ca, for more information about the regulatory body.

The MFDA (Mutual Fund Dealers Association) within Canada is a self-regulatory organization in Canada that offers oversight to the best forex brokers and dealers that distribute mutual funds, and it exempts fixed income products.

It is a licensed body under all Canadian provincial securities and regulators registered with the IIROC regulated (as they maintain strict standards). To find out if it is there, you can search the Dealer Member section.

Regulatory bodies and other co-founder bodies might add to the complexity of the process. Still, the different rules, responsibilities, and regulations benefit retail investors and other forex traders more than it does the regulators because a well-regulated ecosystem can provide more national security.

Thus it makes sense to choose them. Moreover, any income, net income, or salary earned (mostly Canadian dollars, other like US dollars, Japanese yen, British pounds, and Hong Kong dollars, depending on brokers) is subject to capital gains tax to be paid by new clients.

Canadian regulators like British Columbia Securities Commission, Alberta securities commission, Ontario Securities Commission, Vanuatu financial services commission, and Autorite Des Marches Financiers (Quebec) these multiple regulatory agencies are more focused in the province due to being local Canadian regulators who do not operate upkeep rules or regulations in other regions.

They regulate the brokers and check everything to run smoothly, risk management, a qualified accredited investor, and provide excellent trading conditions as they are constantly regulated at the provincial and territorial level.

Safety

While dealing with money, especially for online transactions and FX trading, safety should always be high on the priority list because a compromised industry of Canadian forex brokers would ultimately lead to a high risk of losing money and the downfall of online trading, any constitute financial advice should be handle with care.

Canadian forex traders do get stop loss support. Traders should follow the security measures deployed by the copy trading tools of the platforms before starting Canada forex trading and opening online trading accounts to avoid a high risk of losing money.

So be alert as trading involves risks, avoid fraudulent brokers and be extra careful when dealing with brokers based outside of Canada.

To avoid significant risk, the Canadian securities administrators oversee the working of forex trading in Canada (and Canadian provinces), including the financial institutions and FX brokers, keeping an eye on forex regulation, stock indices, and the fx pairs. Even demo accounts provided by platforms are a great way to learn where you can deposit funds and trade.

Such restrictions and rules can minimize loss and provide security of client funds. Note: some regulators do provide 1 million coverage.

A Canadian forex trader should take a look at the encryption standards used, his financial portfolio, the history of volatility risk, and the industry-standard practices like two-factor authentication for the platforms.

The best Canadian forex broker always is with the support of a debit card or another payment method, one can also consider futures contracts to trade, and it’s always advisable to seek independent advice to avoid the high risk of losing money.

Support CAD Currency

Although there are many FX brokers in the Canadian industry, Canadian residents should use the best forex brokers platforms that support CAD currency. All trading platforms might not allow CAD to be a part of the currency pairs as a payment method and trading cost for exchanging.

Being the local currency for any leading forex broker in the country, CAD currency prices would make for a better option to buy currency pairs, trading forex pairs because of the relatively better exchange rate (like the swiss franc has CHF as its currency) still better to keep an eye on financial markets, entry, and exit positions by traders.

Trading in Canada also has benefits like cash rebates for high-volume trading (buying low, selling high trade, currency pairs exchange). Having access to CAD also makes it an easy transaction with online brokers.

When choosing the best Canadian forex brokers, consider the transaction costs when you trade currency pairs (or exotic pairs), and one also gets Canadian securities administrators’ support.

Trading Fees

Trading rates vary from Canadian forex broker to broker, but there are a few categories where most Canadian forex brokers charge fees based on trading CFDs complex instruments or currency pairs. Service rates form the first step of trading costs that one has to pay to trade platforms for forex trading in Canada, and there are other brokers based in Canada or outside, like IFC markets, Fusion Markets, FP markets, etc., offering discounts on the service rates in some cases.

Still, Canadian investors have to check which promotion is live at any given time in the Canadian market, which is providing real time data (geopolitical news), hot topics of the market, and real time news.

Top Canadian forex brokers also provide perks for the VIP account based on the volume of trading and base currency trading; some may receive compensation via a third party and start forex trading account.

Other prices that an online forex broker can face in Canada for Forex trading are the gas rate or transaction fees charged during transactions (in Canadian dollar) by a few central banks, the financial institution, and deep liquidity providers authorities in the market of the liquidity pool. The demo account charge is usually free.

Apart from these two primary forms of rates, the varying interest rates for currency pairs (significant pairs or exotic currency pairs) as they widely fluctuate should also be of concern with their trading plan and to start trading after understanding all the risk appetite involved, and avoid the high risk of losing.

Trading Platform

- Before Choosing the best Canadian forex broker and the right trading platform to open a single account or per need is more than merely considering the competitive fees and the conversion fees.

- You should also consider what the brokers offer to the customer accounts, and the risks involved; paying particular attention, you should be aware of the risk involved in choosing the wrong platform when trading in Canada.

- For Canadian forex traders, the provincial and territorial level has various brokers operating in the region where beginners and experienced traders of Canada can sign up to start FX trades; this means traders can get benefit from the information and avoid additional risk.

- These top forex brokers in Canada often provide a different mix of features, like stop limit order, MetaTrader 4, MetaTrader 5 support, automated trading, demo account,electronic communication network, ecn xl, (ecn pricing), economic calendar, markets offers, standard lot, micro lot, mini lot options.

- Some may receive compensation via a third party and other functionalities to users as per the Canadian government regulations, which can result in an entirely different experience on every platform.

- Most brokers offer commission free trading in Canada. Generally, Standard account Traders holding this type of account can give you access to a minimum of one standard lot size.

- Choosing an award winning and any top forex broker in Canada would give you competitive spreads (average spread), real time data, and low rates for FX trading while also having the provision to upgrade to a retail investor account or VIP accounts; Blackbull markets also offer leveraged FX trading (flexible leverage ratio).

- Based in Canada, the different types of forex orders entries supported by the trading program should also be considered before trading FX with a broker, as retail investor accounts lose money when trading CFDs or other assets, and that percentage is higher. As forex trading carries risk, retail investor accounts lose money sometimes.

- To avoid that, some trading platforms provide educational guides, economic calendars, trading products (financial products), and even demo account (which is entirely free to use) to make traders familiar with the working environment of forex brokers in Canada.

- One should not overlook the reviews of existing customers and opinions expressed by any broker while deciding the ideal program for trading FX (and choosing a standard account); take advantage of the platform provided, and get started as you get a chance to trade both forex and CFD traders.

- Before you start forex trading, remember a high degree of risk is always involved in trading as retail investor accounts lose money sometimes, which is the Canadian citizens or outsiders’ responsibility, so don’t lose money when trading, and you must also know how the CFDs work.

- Our review process always tries to provide you the accurate information and the latest update on the foreign exchange market and help you choose the

Good Customer Support

Forex trading illegal is not the scenario in Canada, but trading platforms have been known to provide a bad user experience or risk of loss of money supply in the past. It is also a common denominator for trading platforms that lack good customer service support, and one is bound to run into queries or issues.

At the same time, you should know that forex trading is legal in Canada, and having good customer support (e.g., just like TD Ameritrade, FP markets, and Blackbull markets) can be crucial in mitigating problems.

The best broker in the market mainly provides support for phone, email addresses, live chat, and even social media platforms like Facebook messenger. It’s worth noting that the lack of prompt and responsive customer support can be a red flag for any Canadian forex broker, albeit even the best forex broker might have a fixed working hour of customer service support for trading FX.

The Advantages and Disadvantages of Forex Trading

Advantages

One of the significant advantages of Forex trading in Canada is that the user trades globally. The Canada forex broker regulatory body of the Forex exchange market works 24 hours a day, starting from Monday to Friday (5 days a week), offering traders opportunities to operate daily in whatever country they reside.

As the best Canadian forex broker lists are rising day by day, there is increasing access to foreign markets, offering users a chance to transact with the foreign exchange brokers who deal with foreign markets; even accessing the online forex market is advantageous to individual traders.

In recent years, there has been an increase in online brokerages. Using forex trading apps, technical and fundamental analysis, safety with multiple jurisdictions, risk management strategies, and advanced charting makes trading with the forex pair more attractive to traders who want to make short-term market moves or long-term profits.

One of the major plus points of trading in the Canada forex broker market (even for your first trade) as it offers excellent regulatory agencies (regulatory framework) wide selection of trading platforms, demo account support, VIP accounts by some brokers, lower transaction rates associated with the higher initial deposit bonus, commission free, purchasing, high data points in terms of rating, and (standard account support) selling significant currencies.

The online Canadian brokers offering are broad; they offer traders lower transaction prices around the world of forex markets; and other financial instruments; this creates an opportunity for retail investors, and it makes sense to take advantage of the forex trading platform to access and try the forex market and gain access to the information provided, keeping track of their financial situation, and make money when trading CFDs. These additional services allow traders (Canadian residents) to help capture small profits as they grow and begin their forex trading in Canada.

Disadvantages

The forex markets are prone to market volatility; there are frequent variations in the exchange rates (taking overnight positions) which involves a high risk of losing money which is a significant disadvantage.

Other factors like political influence, economic factors, and uncertainty can cause significant price movements, creating a bit complex environment to a certain extent.

Few brokers go the extra mile to offer their users value-added services than other brokers like Fusion Markets, IG markets, and more. As per the reports analysis centre, generally, most Canadian brokers include chart analysis, training courses, social trading, pattern charting, VPN service, zero commission fees, spreads starting as low as possible, financial instruments, and signal trading services which makes them popular among the traders.

Even though there are several benefits, there is no central regulatory authority (EU regulatory framework) to oversee the market insights. The market is divided into several jurisdictions, so the market volatility and the risk involved should be in mind to avoid losing money rapidly.

You must also know how the CFDs work, as forex trading carries a risk, so be alert and invest as if you can afford to take risks; know your financial situation, as it is the own responsibility of the user to check with the trading platforms broker and verify that it comes under Canada IIROC regulated forex brokers before they proceed with the broker. That applies to every country like New Zealand, South Africa, etc.

Conclusion

To conclude, Canada provides online Forex traders with several benefits, and cause of that, users are showing interest in registering with a Canadian forex broker. There are additional trading services (markets offered) by forex brokers in Canada, and a few go the extra mile (offer commission-free trading or low commissions) to offer their users value-added services.

The award-winning best brokers & Canada IIROC regulation enabled, including training programs, social trading, pattern charting, VPN service, technical momentum indicators, providing account manager, and signal trading services.

Even though there are several benefits, there is no central regulatory authority to oversee the market insights as the market is divided into several jurisdictions.

The user’s responsibility is to check if the online forex broker is regulated, safe, and reliable and avoids losses; another crucial thing is to see if the platform meets your requirement, as retail investor accounts lose money when trading CFDs or other assets.

Many brokers offer demo accounts for better understanding as they help make the final decisions. So let’s get started on your forex journey.

FAQs

Which Forex Broker Is Legal in Canada?

Can I Trade Forex in Canada?

Is Forex Trading Allowed in Canada?

Is Forex Trading Legal in Canada?

Is Forex Trading Tax-Free in Canada?

Which Broker Has the Highest Leverage in Canada?

Which Forex Broker Charges the Lowest Fees in Canada?

Which Is Safest Forex Broker in Canada?

Which Forex Broker Is Best for Canadian Traders?

Risk Warning:- CFDs are complex instruments and come with a counterparty risk of losing your money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs.

Retail investor accounts should consider whether they understand how commodity CFDs or others work and whether they can afford to take any risks.